deze week dan maar

Technische Analyse, daytrading en speculatie draad 2012

-

ikasi

- Posts: 49

- Joined: 25 Jun 2012, 21:20

Re: Technische Analyse, daytrading en speculatie draad 2012

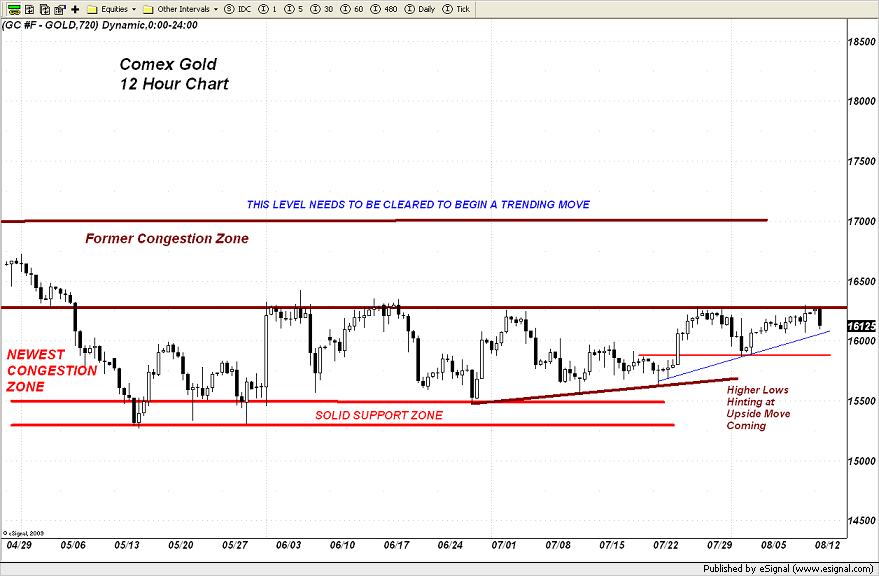

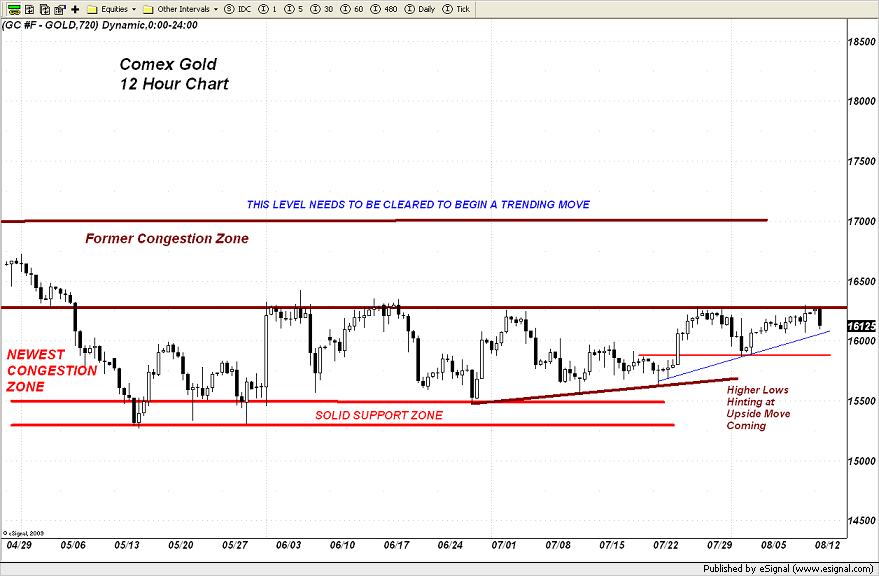

knock, knock op de 1625$...

deze week dan maar

deze week dan maar

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Technische Analyse, daytrading en speculatie draad 2012

Het kan imo niet zo heel lang meer duren voordat goud uitbreekt, maar tsjah .... dat denk ik al even en 't blijft een beetje bij wishfull thinking ...

- Attachments

-

- gold.png (60.13 KiB) Viewed 5423 times

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Technische Analyse, daytrading en speculatie draad 2012

Trader Dan:

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Technische Analyse, daytrading en speculatie draad 2012

10 minuutjes heh .... ruim $20 naar beneden, zonder aanwijsbare oorzaak.

Viva de Amerikaanse toezichthouder op de commodity markten, the CFTC : (Corrupt Futures Trading Commission)

Viva de Amerikaanse toezichthouder op de commodity markten, the CFTC : (Corrupt Futures Trading Commission)

- Attachments

-

- StreamingServer.gif (17.46 KiB) Viewed 5374 times

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Technische Analyse, daytrading en speculatie draad 2012

Mmmm, die aanwijsbare oorzaak is er dus WEL. Ik had niet gedacht dat de hedgefunds ZO fel op de 'retail sales' zouden reageren. Wel is het zo, dat er fundamenteel gekocht wordt (is al langere tijd gaande) waardoor de bodem onder goud steeds iets hoger komt te liggen. Dat betekent overigens, dat 'als er eenmaal QE3 komt', de hedgefunds goud stijl omhoog kunnen jagen. Norcini legt het onderstaand uit:

========================================================================================

Tuesday, August 14, 2012

Retail Sales Number Derails QE Expectations

This morning's Retail Sales number came in above expectations giving those expecting a Fed move on the QE front at the upcoming Jackson Hole summit reason for pause. The number caught a lot of folks off guard and while it was not spectacular, it was not in the "the consumer is not spending money" category. The market interpretted it as another reason for the Fed NOT TO ACT.

Gold, which had been moving higher in its recent consolidation range until yesterday, immediately fell back on the data as the further squashing of another round of bond buying in early September seems even more remote at this point.

Still it did attract value based buying just above the $1590 level and is currently back above the psychologically significant $1600 level. Whether it can stay there without strong expectations of a forthcoming QE is unclear however.

It does seem as if stubborn strength in crude oil, particularly in Brent, is keeping selling from becoming too aggressive in gold especially with the bonds moving lower and interest rates moving up again. The CCI and the CRB are both higher today which helps feed into more of an inflation scenario rather than the deflationary psyche which has gripped these markets for so long. Additionally, an article in a prestigious European based newspaper dealing with a potential breakup of the Euro has kept a decent floor under the gold price.

A quick explanation for those who seem unclear about my comments from yesterday regarding hedge fund money flows. I mentioned that gold needs a spark to break it out of this range to the upside; one which will bring in speculative flows from the hedgies on the long side of the market to send it forth on a trending move higher. Let me remind those who are unclear on this - hedge fund money flows dominate our financial markets today, whether we like it or not. If they are not committing to a market in size on the long side, it is not going to be able to sustain a trending move higher. Most of that crowd are momentum players meaning that they need to find a market that is moving and has some momentum to it, whether that is up or down, in order to make any money off of their algorithms. For the most part, the hedge fund crowd is mindless relying on its computers to do their thinking for them. When markets range trade, they lose interest because these systems generally do not perform well in sideways markets. Locals and other large traders love these conditions on the other hand.

What is supporting gold on the downside is not hedge fund money but rather value based buying originating out of Asia and from other large entities which actually study fundamentals and make buying or selling decisions based upon that analysis. We curse the hedge funds when they are liquidating longs or establishing new short positions in gold or in silver but keep in mind, it is these same clumsy trading clods that also drive these metals higher when their computers flip over to the buy side. Love 'em or hate 'em, they are a force to be reckoned with; any analysis of the markets that disregards their impact is not worth the paper it is written on.

Posted by Trader Dan at 11:27 AM

========================================================================================

Tuesday, August 14, 2012

Retail Sales Number Derails QE Expectations

This morning's Retail Sales number came in above expectations giving those expecting a Fed move on the QE front at the upcoming Jackson Hole summit reason for pause. The number caught a lot of folks off guard and while it was not spectacular, it was not in the "the consumer is not spending money" category. The market interpretted it as another reason for the Fed NOT TO ACT.

Gold, which had been moving higher in its recent consolidation range until yesterday, immediately fell back on the data as the further squashing of another round of bond buying in early September seems even more remote at this point.

Still it did attract value based buying just above the $1590 level and is currently back above the psychologically significant $1600 level. Whether it can stay there without strong expectations of a forthcoming QE is unclear however.

It does seem as if stubborn strength in crude oil, particularly in Brent, is keeping selling from becoming too aggressive in gold especially with the bonds moving lower and interest rates moving up again. The CCI and the CRB are both higher today which helps feed into more of an inflation scenario rather than the deflationary psyche which has gripped these markets for so long. Additionally, an article in a prestigious European based newspaper dealing with a potential breakup of the Euro has kept a decent floor under the gold price.

A quick explanation for those who seem unclear about my comments from yesterday regarding hedge fund money flows. I mentioned that gold needs a spark to break it out of this range to the upside; one which will bring in speculative flows from the hedgies on the long side of the market to send it forth on a trending move higher. Let me remind those who are unclear on this - hedge fund money flows dominate our financial markets today, whether we like it or not. If they are not committing to a market in size on the long side, it is not going to be able to sustain a trending move higher. Most of that crowd are momentum players meaning that they need to find a market that is moving and has some momentum to it, whether that is up or down, in order to make any money off of their algorithms. For the most part, the hedge fund crowd is mindless relying on its computers to do their thinking for them. When markets range trade, they lose interest because these systems generally do not perform well in sideways markets. Locals and other large traders love these conditions on the other hand.

What is supporting gold on the downside is not hedge fund money but rather value based buying originating out of Asia and from other large entities which actually study fundamentals and make buying or selling decisions based upon that analysis. We curse the hedge funds when they are liquidating longs or establishing new short positions in gold or in silver but keep in mind, it is these same clumsy trading clods that also drive these metals higher when their computers flip over to the buy side. Love 'em or hate 'em, they are a force to be reckoned with; any analysis of the markets that disregards their impact is not worth the paper it is written on.

Posted by Trader Dan at 11:27 AM

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

- Spruitje

- Freegold Member

- Posts: 2595

- Joined: 19 Oct 2011, 01:34

Re: Technische Analyse, daytrading en speculatie draad 2012

Study while others are sleeping; work while others are loafing; prepare while others are playing; and dream while others are wishing.

- William Arthur Ward -

- William Arthur Ward -

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Technische Analyse, daytrading en speculatie draad 2012

T'is inderdaad zoals trader DAN schrijft. Die hedgefund machines reageren op ieder ingeprogrammeerd nieuws:

Reuters: Thu Aug 16, 2012 10:52am EDT

Manufacturing activity in the mid-Atlantic region shrank in August for the fourth straight month, a worrisome sign for the economic recovery although the pace of contraction eased.

The Philadelphia Federal Reserve Bank said its business activity index was at minus 7.1 in August, a smaller contraction than registered in July. Economists were expecting a reading of minus 5.

In the Philadelphia Fed report, any reading below zero indicates contraction in the region's manufacturing. The survey covers factories in eastern Pennsylvania, southern New Jersey and Delaware.

===================

En dáár reageren de machines op, want 'wie weet', dan toch strakjes een QE ronde ..... en hoppa $gold weer ruim een tientje naar boven ....

Reuters: Thu Aug 16, 2012 10:52am EDT

Manufacturing activity in the mid-Atlantic region shrank in August for the fourth straight month, a worrisome sign for the economic recovery although the pace of contraction eased.

The Philadelphia Federal Reserve Bank said its business activity index was at minus 7.1 in August, a smaller contraction than registered in July. Economists were expecting a reading of minus 5.

In the Philadelphia Fed report, any reading below zero indicates contraction in the region's manufacturing. The survey covers factories in eastern Pennsylvania, southern New Jersey and Delaware.

===================

En dáár reageren de machines op, want 'wie weet', dan toch strakjes een QE ronde ..... en hoppa $gold weer ruim een tientje naar boven ....

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

-

Marco

- Posts: 5

- Joined: 18 Aug 2012, 17:32

Re: Technische Analyse, daytrading en speculatie draad 2012

Long-Term Technical Outlook for Gold & Silver

Jordan Roy-Byrne, Aug 19, 2012

http://thedailygold.com/long-term-techn ... ld-silver/

Jordan Roy-Byrne, Aug 19, 2012

http://thedailygold.com/long-term-techn ... ld-silver/

- Spruitje

- Freegold Member

- Posts: 2595

- Joined: 19 Oct 2011, 01:34

Re: Technische Analyse, daytrading en speculatie draad 2012

Goud intussen naar de 1650$ en $ naar 1.255, samen de trap op...

EDIT:

Reden.... FED

EDIT:

Reden.... FED

Uit: De Tijd © (te lezen in beveiligde modus IE)Veel leden oordeelden dat bijkomende monetaire versoepeling waarschijnlijk vrij spoedig gewettigd zou zijn, tenzij nieuwe informatie wijst op een substantiële en duurzame verbetering in het tempo van het economische herstel’, zo klinkt het in de notulen.

Study while others are sleeping; work while others are loafing; prepare while others are playing; and dream while others are wishing.

- William Arthur Ward -

- William Arthur Ward -

-

Marco

- Posts: 5

- Joined: 18 Aug 2012, 17:32

Re: Technische Analyse, daytrading en speculatie draad 2012

It's Risky to Anticipate QE

By: Steve Saville

Gold and "risk" assets rally whenever traders get the faintest scent that more QE (a central bank program designed to increase the money supply) is coming. Our view is that while more QE will eventually happen, buying in anticipation of such a policy move is fraught with danger.

Things are bad enough in the euro-zone (EZ) to justify* more QE at any time. Also, the rate of monetary inflation is low in the EZ, which lends support to the assertion that the ECB could do more good than harm by pumping money into the economy. However, the Fed is not in a position to implement another QE program in the near future, for the following reasons.

First, QE2 is widely (and correctly) perceived as a failure. In particular, a critical mass of people is aware that QE2 elevated the stock market and the cost of living, but did nothing to improve economic conditions for the average person.

Second, with the election less than 5 months away there would be a huge political backlash against the Fed if it initiated a new round of QE without an airtight excuse. To be politically feasible, the QE would have to be in response to a US (not EZ) economic emergency. To put it more clearly, things would have to get much worse for the US economy, the US stock market and/or the US banking system before more Fed QE would become a politically viable option.

Third, given the current grotesque size of its balance sheet the Fed would rather reduce than increase monetary accommodation. That's why the actions it has taken over the past 11 months have changed the mix of items on its balance sheet but haven't increased the balance sheet's overall size. More QE would result in a large increase in the Fed's balance sheet, which the Fed would prefer to avoid if at all possible.

Here is another point worth contemplating. Even if we make the dubious assumption that the Fed is prepared to adjust monetary policy to improve Obama's chances of being re-elected, there is no guarantee that more QE over the months ahead would help achieve such an objective. It could actually achieve the opposite. This is because beyond knee-jerk reactions in all markets, there's a realistic possibility that a new QE program would do nothing other than raise the prices of oil and gold (and silver -- when we say gold we mean gold and silver) while the economy continued to weaken. In fact, the only price that would be sure to make a large and sustainable gain on the back of more QE is the price of gold. There was a preview of what we are talking about on 1st June, when much weaker-than-expected US employment data sparked the idea that more QE was on the way. Gold quickly rose $60 while the prices of most other assets fell.

As an aside, the Fed could take a backdoor approach to increased monetary accommodation by encouraging the commercial banks to lend more money into existence. This is something we discussed last year and could be done by cutting the interest rate paid by the Fed on excess reserves or, if that failed to provide sufficient incentive for the banks to put the reserves to work, charging the banks to hold excess reserves. This course of action could boost the money supply without drawing unwanted political attention to the Fed.

Summing up, the prices of many assets will probably move a lot lower between now and when the Fed announces a new monetary inflation program. Furthermore, if speculators 'jump the gun' and bid up asset prices in anticipation of future Fed-sponsored inflation they will eliminate the justification for the inflation. In other words, the more that prices rise in anticipation of a new round of QE the less reason there will be for central banks to implement a new round of QE.

The upshot is that there is a lot more to be lost than gained by making large purchases of anything in anticipation of QE. A more prudent approach would entail waiting for the formal announcement before establishing QE-related trading positions. The right positioning could then be determined based on market prices at the time.

By: Steve Saville

Gold and "risk" assets rally whenever traders get the faintest scent that more QE (a central bank program designed to increase the money supply) is coming. Our view is that while more QE will eventually happen, buying in anticipation of such a policy move is fraught with danger.

Things are bad enough in the euro-zone (EZ) to justify* more QE at any time. Also, the rate of monetary inflation is low in the EZ, which lends support to the assertion that the ECB could do more good than harm by pumping money into the economy. However, the Fed is not in a position to implement another QE program in the near future, for the following reasons.

First, QE2 is widely (and correctly) perceived as a failure. In particular, a critical mass of people is aware that QE2 elevated the stock market and the cost of living, but did nothing to improve economic conditions for the average person.

Second, with the election less than 5 months away there would be a huge political backlash against the Fed if it initiated a new round of QE without an airtight excuse. To be politically feasible, the QE would have to be in response to a US (not EZ) economic emergency. To put it more clearly, things would have to get much worse for the US economy, the US stock market and/or the US banking system before more Fed QE would become a politically viable option.

Third, given the current grotesque size of its balance sheet the Fed would rather reduce than increase monetary accommodation. That's why the actions it has taken over the past 11 months have changed the mix of items on its balance sheet but haven't increased the balance sheet's overall size. More QE would result in a large increase in the Fed's balance sheet, which the Fed would prefer to avoid if at all possible.

Here is another point worth contemplating. Even if we make the dubious assumption that the Fed is prepared to adjust monetary policy to improve Obama's chances of being re-elected, there is no guarantee that more QE over the months ahead would help achieve such an objective. It could actually achieve the opposite. This is because beyond knee-jerk reactions in all markets, there's a realistic possibility that a new QE program would do nothing other than raise the prices of oil and gold (and silver -- when we say gold we mean gold and silver) while the economy continued to weaken. In fact, the only price that would be sure to make a large and sustainable gain on the back of more QE is the price of gold. There was a preview of what we are talking about on 1st June, when much weaker-than-expected US employment data sparked the idea that more QE was on the way. Gold quickly rose $60 while the prices of most other assets fell.

As an aside, the Fed could take a backdoor approach to increased monetary accommodation by encouraging the commercial banks to lend more money into existence. This is something we discussed last year and could be done by cutting the interest rate paid by the Fed on excess reserves or, if that failed to provide sufficient incentive for the banks to put the reserves to work, charging the banks to hold excess reserves. This course of action could boost the money supply without drawing unwanted political attention to the Fed.

Summing up, the prices of many assets will probably move a lot lower between now and when the Fed announces a new monetary inflation program. Furthermore, if speculators 'jump the gun' and bid up asset prices in anticipation of future Fed-sponsored inflation they will eliminate the justification for the inflation. In other words, the more that prices rise in anticipation of a new round of QE the less reason there will be for central banks to implement a new round of QE.

The upshot is that there is a lot more to be lost than gained by making large purchases of anything in anticipation of QE. A more prudent approach would entail waiting for the formal announcement before establishing QE-related trading positions. The right positioning could then be determined based on market prices at the time.