Novagold lijkt aan te geven dat goud voor een paar maand in rustiger vaarwater zit.

Loopt altijd voor op de rest....

Of onze Nestor nog leeft ?

Dieu le sait.

Had em altijd wel eens willen ontmoeten.

Goud en Zilvermijnen

-

Leo3.14

- Gold Member

- Posts: 1574

- Joined: 14 Dec 2013, 21:52

Re: Goud en Zilvermijnen

Goud is een cyclisch edelmetaal

-

Dirkgold

- Platinum Member

- Posts: 659

- Joined: 01 Sep 2012, 19:54

Re: Goud en Zilvermijnen

http://www.marketoracle.co.uk/Article50390.html

Are Gold Stocks the Cheapest Ever?

Are Gold Stocks the Cheapest Ever?

- Gwyde

- Platinum Member

- Posts: 630

- Joined: 19 Oct 2011, 23:49

- Contact:

Re: Goud en Zilvermijnen

MINING PICKS: Which Gold Mining Stocks Are On Mickey Fulp’s Mind?

Mickey Fulp, best known under his legendary nick "The Mercenary Geologist" has a long standing love & hate relationship with gold miners. Gold mining majors are not his favourites, if anything 'gold' he puts his hope in the few explorer-developers around which have identified high grade resources with the potential of being turned into profitable mines.

He does look beyond the gold sector, focusing both on other precious metals, non-ferro metals and uranium/thorium.

An interview with Kitco reporter Alex Letourneau:

Mickey Fulp, best known under his legendary nick "The Mercenary Geologist" has a long standing love & hate relationship with gold miners. Gold mining majors are not his favourites, if anything 'gold' he puts his hope in the few explorer-developers around which have identified high grade resources with the potential of being turned into profitable mines.

He does look beyond the gold sector, focusing both on other precious metals, non-ferro metals and uranium/thorium.

An interview with Kitco reporter Alex Letourneau:

Kitco News kicks off a brand new monthly show as "Mining Picks: The Rough" airs its maiden voyage with the Mercenary Geologist, Mickey Fulp. The industry veteran highlights a few resource companies that he has his eye on in this tough gold price environment. He also lays out his two cents on senior gold producers and why he’s avoiding them until they can get right the ship and focus solely on quality vs. quantity. Tune in now to hear what one of the industry’s best has to say about gold mining stocks.

Gwyde

Mining Corner

Mining Corner

- Gwyde

- Platinum Member

- Posts: 630

- Joined: 19 Oct 2011, 23:49

- Contact:

Gold and the miners: identifying the bear market logic

Gold and the miners: identifying the bear market logic

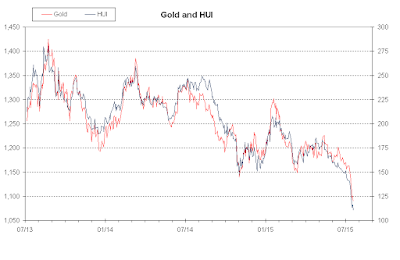

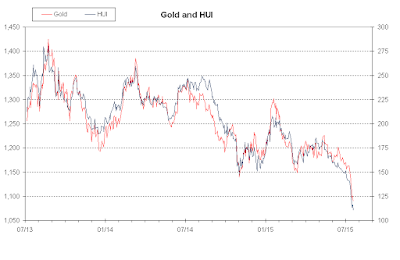

During the early years of the secular gold bull in the previous decade, gold miners have been outperforming the metal by a more than decent margin. In its second phase, gold rose almost in lock-step with the miners, when approximating those using the ARCA index of unhedged gold miners (HUI). The narrow range of the HUI relative to bullion has been used as a trading rule, successfully... until it failed as all ' trading rules' did in the 2008 financial crisis.

(...) verder lezen via bovenstaande link

During the early years of the secular gold bull in the previous decade, gold miners have been outperforming the metal by a more than decent margin. In its second phase, gold rose almost in lock-step with the miners, when approximating those using the ARCA index of unhedged gold miners (HUI). The narrow range of the HUI relative to bullion has been used as a trading rule, successfully... until it failed as all ' trading rules' did in the 2008 financial crisis.

(...) verder lezen via bovenstaande link

Gwyde

Mining Corner

Mining Corner

-

Leo3.14

- Gold Member

- Posts: 1574

- Joined: 14 Dec 2013, 21:52

Re: Goud en Zilvermijnen

continuationgap.Leo3.14 wrote:Novagold lijkt aan te geven dat goud voor een paar maand in rustiger vaarwater zit.

Loopt altijd voor op de rest....

Goud is een cyclisch edelmetaal

-

Leo3.14

- Gold Member

- Posts: 1574

- Joined: 14 Dec 2013, 21:52

Re: Goud en Zilvermijnen

Novagold terug boven 50mA daily: look @ that volume !!Leo3.14 wrote:continuationgap.Leo3.14 wrote:Novagold lijkt aan te geven dat goud voor een paar maand in rustiger vaarwater zit.

Loopt altijd voor op de rest....

Nog meer zijwaartse leuterkoek in $ op het menu komende maanden wellicht.

Ik verwacht de daling in $ pas eind dit jaar (net als de beslissing omtrent Griekenland)

€-goud kan intussen hoger :

De oververkochte positie van de €/$ ratio is intussen weggewerkt :€ klaar om verder te dalen ?

Goud is een cyclisch edelmetaal

- Indiana Jones

- Freegold Member

- Posts: 4765

- Joined: 05 Oct 2011, 16:00

- Contact:

Re: Goud en Zilvermijnen

The Friday sell-off in gold was led by Barrick Gold Corp (NYSE:ABX, TSE:ABX), which is the world’s leading producer as its shares fell 5% to the lowest in USD terms since 1990.

Barrick’s market value is now down 32% over the last three months alone bringing its market-cap to just under $14 billion in New York down from $64 billion at its peak in 2011.

Barrick’s gold production is expected to fall further as it faces an oppressive debt-load of more than $13 billion – an amount equal now to nearly the total value of shares.

This warns that a rate hike may see the value of Barric collapse even further.

Denver-based Newmont mines is actually the only gold company that forms part of the S&P500 index and is the second largest producer fell under under 3% on Friday.

ADRs of AngloGold Ashanti (NYSE:AU), the world’s third largest gold producer in terms of output fell 5.8% for a market value of $3.1 billion on the NYSE.

Barrick’s market value is now down 32% over the last three months alone bringing its market-cap to just under $14 billion in New York down from $64 billion at its peak in 2011.

Barrick’s gold production is expected to fall further as it faces an oppressive debt-load of more than $13 billion – an amount equal now to nearly the total value of shares.

This warns that a rate hike may see the value of Barric collapse even further.

Denver-based Newmont mines is actually the only gold company that forms part of the S&P500 index and is the second largest producer fell under under 3% on Friday.

ADRs of AngloGold Ashanti (NYSE:AU), the world’s third largest gold producer in terms of output fell 5.8% for a market value of $3.1 billion on the NYSE.

Everything that needs to be said has already been said.

But since no one was listening, everything must be said again.

But since no one was listening, everything must be said again.

- Gwyde

- Platinum Member

- Posts: 630

- Joined: 19 Oct 2011, 23:49

- Contact:

Better than tomorrow

Africans have a peculiar sense of humor. When asking 'Comment ça va à Kinshasa?', an answer often heard used to be "Mieux que demain" ('Better than tomorrow'). It adequately describes what mood precious metals are in. Irrespective of whether global stock markets are dipping or recovering and challenging all time highs, precious metal markets know only one direction. A summer slump is a recurrent phenomenon, yet now it lingers on from mid May onward.

(drafted over the WE, with fresh comments added)

Triple digit platinum (as I stated was in the cards) ultimately materialized last Friday. (Previous occurrence of triple digit Platinum was in February 2009, which puts us at a +6 year low.) Gold closing at $1133 puts us at a five year low. For an LBMA silver fix below the current $14.84, we equally need to return to Sept 1, 2009. While Palladium 'only' is near a three year low, its price has been plunging faster than any of the other precious metals.

Miners have been crashing, with the HUI/Gold ratio now below its December 2014 trough at 0.114. The HUI index equally slid considerably below its mid December 2014 bottom level. You find fresh graphs on the gold miner pulse blog page. Since the previous update on Jul 6, the HUI posts a 15.1% loss, while the benchmarks GDX and GDXJ are off -13.6% and 11.1% respectively. SIL slides 13.45%.

With a 8.69% loss, our contributor driven explorer & junior miner spreadsheet compares favourably, if that can be any consolation. We thereby equal the performance of GLDX (the explorer ETF) which was the less bad of our benchmark ETFs. Since last update, there are 2 list components up little (PVG and CNL), against 15 down, with Eurasian Minerals flat. Several double digit slides are a drag on our list performance.

***

Yesterday the slide aggravated with gold breaking below $1100 for the first time since 2010: a fresh 5 year low. Few miners lost more on a day than they did year-to-date. Today's timid recovery won't bring about any substantial improvement.

(drafted over the WE, with fresh comments added)

Triple digit platinum (as I stated was in the cards) ultimately materialized last Friday. (Previous occurrence of triple digit Platinum was in February 2009, which puts us at a +6 year low.) Gold closing at $1133 puts us at a five year low. For an LBMA silver fix below the current $14.84, we equally need to return to Sept 1, 2009. While Palladium 'only' is near a three year low, its price has been plunging faster than any of the other precious metals.

Miners have been crashing, with the HUI/Gold ratio now below its December 2014 trough at 0.114. The HUI index equally slid considerably below its mid December 2014 bottom level. You find fresh graphs on the gold miner pulse blog page. Since the previous update on Jul 6, the HUI posts a 15.1% loss, while the benchmarks GDX and GDXJ are off -13.6% and 11.1% respectively. SIL slides 13.45%.

With a 8.69% loss, our contributor driven explorer & junior miner spreadsheet compares favourably, if that can be any consolation. We thereby equal the performance of GLDX (the explorer ETF) which was the less bad of our benchmark ETFs. Since last update, there are 2 list components up little (PVG and CNL), against 15 down, with Eurasian Minerals flat. Several double digit slides are a drag on our list performance.

***

Yesterday the slide aggravated with gold breaking below $1100 for the first time since 2010: a fresh 5 year low. Few miners lost more on a day than they did year-to-date. Today's timid recovery won't bring about any substantial improvement.

Gwyde

Mining Corner

Mining Corner

- Gwyde

- Platinum Member

- Posts: 630

- Joined: 19 Oct 2011, 23:49

- Contact:

Gold miner bear market logic

The bear market logic for miners: Continuation and Analysis

The summer slump for precious metals has turned into a nightmare, with gold breaking below $1100, platinum into the triple digits and silver well below $15. While the July slide is pretty bad, what makes it worse is precious metals setting fresh multi-year lows.

Compared to the plunge among miners however, the precious metals sell-off seems rather meek: the HUI/Gold ratio is threatening to drop below 0.100, which is five times lower than its 2003-08 equilibrium level and over four times lower than where HUI/Gold recovered to in 2009-2010.

In May, I drafted an article titled: Gold and the miners: identifying the bear market logic. After the latest sell-off it is worth checking whether the 'bear-market-logic' for the miners still holds.

Identifying the bear market logic

Let's start with an update of the graph the previous article ended with: Gold price (left scale) and the HUI miners index (right scale) are shown to match rather well. The oscillatory down trend of the HUI/Gold ratio ever since 2011 implies that a proportional logic is not holding any longer.

Gold (red, left scale in USD/Oz) and HUI (blue, right scale)

Continuation and/or a full resolution graph on the above link

The summer slump for precious metals has turned into a nightmare, with gold breaking below $1100, platinum into the triple digits and silver well below $15. While the July slide is pretty bad, what makes it worse is precious metals setting fresh multi-year lows.

Compared to the plunge among miners however, the precious metals sell-off seems rather meek: the HUI/Gold ratio is threatening to drop below 0.100, which is five times lower than its 2003-08 equilibrium level and over four times lower than where HUI/Gold recovered to in 2009-2010.

In May, I drafted an article titled: Gold and the miners: identifying the bear market logic. After the latest sell-off it is worth checking whether the 'bear-market-logic' for the miners still holds.

Identifying the bear market logic

Let's start with an update of the graph the previous article ended with: Gold price (left scale) and the HUI miners index (right scale) are shown to match rather well. The oscillatory down trend of the HUI/Gold ratio ever since 2011 implies that a proportional logic is not holding any longer.

Gold (red, left scale in USD/Oz) and HUI (blue, right scale)

Continuation and/or a full resolution graph on the above link

Gwyde

Mining Corner

Mining Corner

- Spruitje

- Freegold Member

- Posts: 2581

- Joined: 19 Oct 2011, 01:34

Re: Goud en Zilvermijnen

Even nog 'n postje ophalen van oktober 2011, een van de eerste postjes in deze draad...

We zijn nog geen vier jaar verder en alles kan zo de prullenbak in.

Als iedereen het eens is... dan is het tijd om de matras te draaien.

dan is het tijd om de matras te draaien.

Zoals Gwyde mooi zegt... 'oordeel zelf'.Gwyde wrote:Goeroe's zijn het erover eens: "Cheap gold stocks"

Adam Hamilton exploreert opnieuw de HUI/Gold ratio. Hij vervoegt daarbij illustere andere goeroes als John Doody, Doug Casey, Rick Rule, Brent Cook ...

Oordeel zelf: http://www.zealllc.com/2011/cheaphuipf.htm

We zijn nog geen vier jaar verder en alles kan zo de prullenbak in.

Als iedereen het eens is...

Study while others are sleeping; work while others are loafing; prepare while others are playing; and dream while others are wishing.

- William Arthur Ward -

- William Arthur Ward -